Peddlr raised $4.3 M to help Filipino SMEs with inventory and accountancy

Patamar Capital and Crestone Venture Capital have co-led a seed fundraising round for Peddlr, a Filipino inventory, and company financial management firm.

New investors January Capital, 500 Southeast Asia, Nordstar, Vulpes Ventures, KDV Capital, and 335 Fund joined existing investors Foxmont Capital Partners and Kaya Founders.

Summit Media President Lisa Gokongwei, Zalora Group CCO Giulio Xiloyannis, Zalora Group COO Rostin Javadi, Kippa Founder and CEO Kennedy Ekezie-Joseph, Antler Co-Founder Jussi Salovaara, Antler Indonesia Partner Subir Lohani, Antler Southeast Asia Associate Partner Markus Bruderer, and XA Network were among the angel investors in the round.

The monies will be used to help Peddlr reach one million micro and small companies by the end of 2022. It will also accelerate the development of new app features and digital goods that will benefit its customers, particularly sari-sari businesses and other micro-enterprises.

The round follows Peddlr’s US $500,000 pre-seed round, which ended in November 2021.

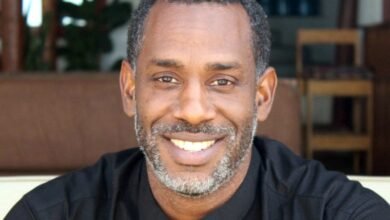

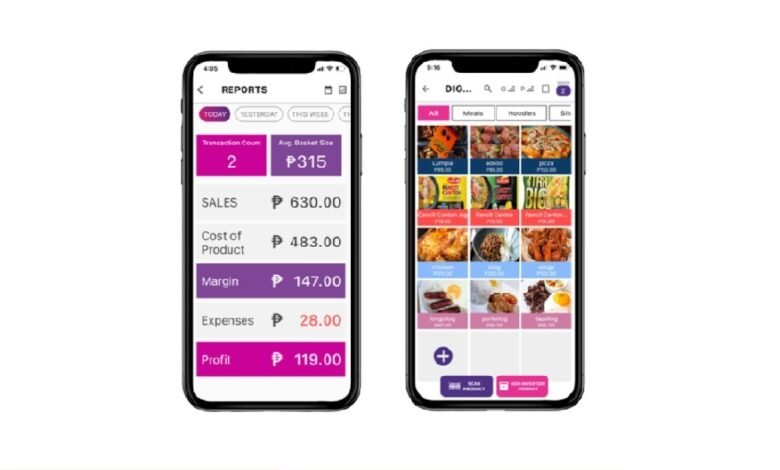

Peddlr is a smart point-of-sale (POS) smartphone app that was founded in 2020 by CEO Nel Laygo and COO Aiko Reyes to enable micro and small enterprises to manage inventory, simplify bookkeeping, and construct digital storefronts.

Its digital ledgers for cash, credit, and payment enable businesses to improve cash flow visibility with auto-generated financial reports, eliminating the traditional pen-and-paper sales recording, credit management, and manual inventory stock counting procedure.

So far, Peddlr claims to have seen organic exponential growth, with over 350,000 downloads and 28,000 active users.

In 2020, the Philippines’ Department of Trade and Industry recorded 952,969 micro, small, and medium firms, accounting for 99.51 percent of all businesses registered. However, these enterprises, which are largely found in rural regions, are believed to underperform since they account for just 36% of the economy’s value contributed, according to the World Economic Forum. Poor internet infrastructure and digital skills, as well as financial and policy shortages, are all obstacles.

After a $300 million funding round in November, Mynt, a firm that provides financial solutions in mobile money, loans, and buy-now-pay-later, became the Philippines’ first fintech unicorn.