Alternative lending, digital banking, payments & transfers, e-wallets in South and Southeast Asia raised $53.3 B

According to a study released by Robocash Group last Thursday, over the course of history, fintechs in the alternative lending, digital banking, payments and transfers, and e-wallet sectors have raised a combined $53.3 billion and made $17.8 billion.

The study’s findings indicate that the overall rate of return (total revenue / total funding) is roughly 33.4%, which means that for every dollar attracted, fintechs make an average of 33.4 cents in annual revenue from transactions involving their activities.

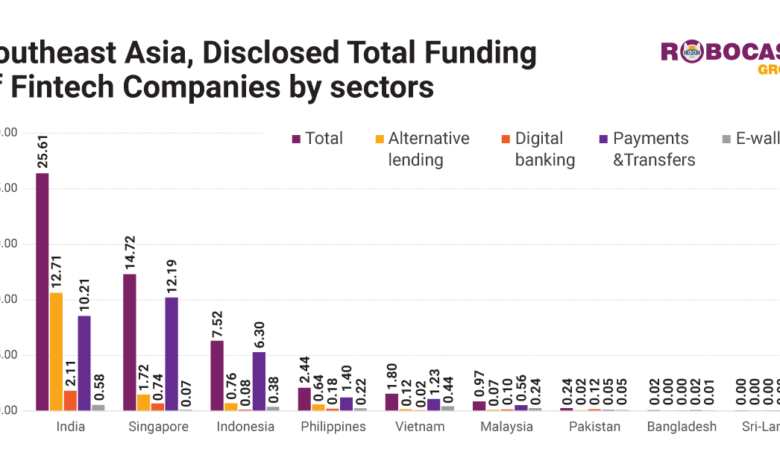

The study also revealed that India receives $25.6 billion (48 percent) and Singapore receives $14.7 billion (27.6 percent) of the total funds.

Indonesia comes in second with $7.5 billion (14.1%), followed by the Philippines with $2.4 billion (3.4%), Vietnam with $1.8 Bn (3.4%), and Malaysia with $966 million (1.8%).

The smallest amount of money is going to Pakistan, which is receiving $240 million (0.5%), Bangladesh, which is receiving $24 million (0.05%), and Sri Lanka, which is receiving $307,000 (0.001%).

India, Indonesia, and Singapore had the highest incomes in 2021.

India generated $10 billion in revenue (57.2%), followed by Singapore ($1.9 billion, 10.6%), Indonesia ($2.4 billion), and Indonesia ($2.4 billion).

The Philippines come in second with $875 million (4.9 percent), and Vietnam leads with $1.7 billion (9.4 percent) in revenue. Sri Lanka contributes the least, at 24 million (0.1 percent), followed by Bangladesh, Malaysia, and Pakistan with $287 million (1.6 percent), 283 million (1.6 percent), and 167 million (0.9 percent), respectively.

It is noteworthy that India, which accounts for 53.8% of all companies, has the highest concentration of investment stages, followed by Singapore (14.3%) and Indonesia (8%).

The alternative lending sector accounts for 45.8% of fintech companies’ investment activity, followed by payments and transfers (38.8%), digital banking (8.5%), and e-wallets (6.9%).

Strangely enough, Bangladesh is the most efficient nation in terms of return on investment (total revenue / total funding), followed by Pakistan (686.4%), Vietnam (117.6%), Indonesia (68.7%), Malaysia (48.5%), the Philippines (39.7%), Sri Lanka (29.7%), India (25%) and Singapore (16.5%).

Due to their almost non-existent fundraising rates and revenue levels that are still below the SEA average, Bangladesh and Pakistan, the first two countries, have such extreme values.

To date, $16.4 billion has been raised by businesses that have reached the public stage.

India has the highest concentration of investment stages (excluding unfunded) at 53.8% (444), followed by Singapore with 14.3% (118), Indonesia with 8% (66), Malaysia with 6.5 (54), Vietnam with 6.1 (50), the Philippines with 5.9 (49), Pakistan with 3.8 (31), Bangladesh with 1.1 (9) and Sri Lanka with 0 (%).