After $23 B in Q1 losses, SoftBank’s founder promised cost cuts

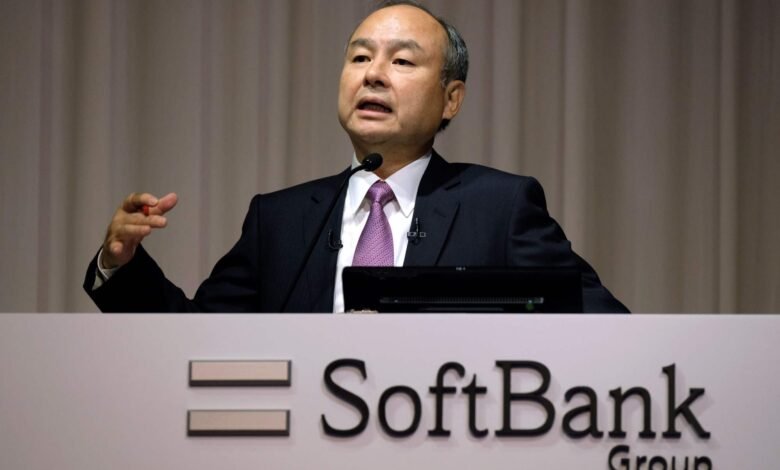

After suffering losses of US $23 billion in the most recent quarter, Masayoshi Son, the founder of Japanese giant SoftBank, stated that he would be undertaking cost cutbacks across the organization, according to Bloomberg.

The group’s Vision Funds are responsible for losses of $17.3 billion, according to the company’s most recent financial announcement.

Son admitted fault and assured that “everything” will be reviewed for possible cutbacks. The front and back offices of this company both included junior and senior staff.

The founder of SoftBank also mentioned that 284 portfolio firms had been written down in the most recent quarter. Only 35 of the companies in its portfolio have seen value increases.

With just US $600 million in investments allowed in the most recent quarter, the firm is now repressing future investments as well. This is a considerable decrease from US$20.6 billion in the same period a year earlier.

As well as its holding in the online personal finance company SoFi Technologies, SoftBank is negotiating to sell its subsidiary Fortress Investment Group.

In morning trade, shares of the Japanese giant have decreased by nearly 3%. Son initiated a share buy-back program with the goal of buying up to 400-billion-yen ($2.9 billion) worth of its own shares in an effort to boost share prices.