VinVentures capital fund launched by Vietnam’s Vingroup with $150 M AUM

With $150 million in total assets under management, Vingroup, a conglomerate based in Vietnam, announced the opening of the VinVentures capital fund on Monday.

In order to support and grow the startup ecosystem, the fund is committed to investing in high-impact technology startups, the group said in a statement.

The establishment of digital technology businesses in Vietnam and the surrounding area is anticipated to be greatly aided by this initiative.

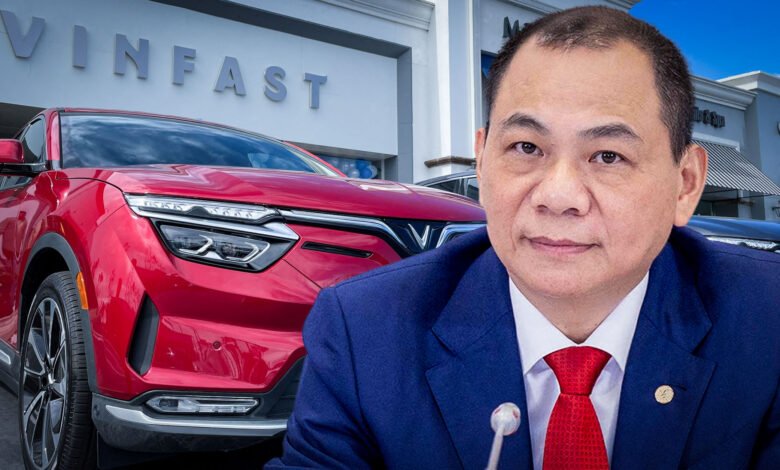

Pham Nhat Vuong and Vingroup are the sponsors of the capital fund VinVentures. Earlier reports claimed that Pham, a property and car tycoon, was the richest person in Vietnam.

With an additional $50 million anticipated to be distributed over the next three to five years, the fund currently manages $150 million in total assets, of which $100 million is an inherited investment portfolio from Vingroup.

VinVentures’ main areas of investment are cloud computing, semiconductors, artificial intelligence (AI), and other high-tech goods.

Though not restricted to Vingroup-affiliated startups, the fund also accepts startups from a variety of industries as long as they show growth potential and the capacity to provide high-quality goods and services.

In the early stages, particularly the seed and Series A rounds—the second and third of five normal funding rounds for startups—the fund focuses on startups with local founding teams, with an initial focus on the Vietnamese market.

The fund intends to expand its reach in the future to include startups in regional markets like Singapore, Indonesia, and the Philippines that share development characteristics with Vietnam, the company stated.

Initial meetings, information sharing, in-depth product and target market research, comprehensive investment appraisal, signing of negotiation agreements, and finally the final investment contract are the steps that the fund takes to work with potential investors.

From the time a startup submits its application until it receives funding, it usually takes two to three months, with larger-scale transactions taking up to six months.

Le Han Tue Lam, Managing Director of VinVentures, stated, ‘Beyond providing capital, VinVentures offers startups a unique advantage by facilitating connections within the Vingroup ecosystem. This includes using the ecosystem as a rigorous platform for evaluating and testing products and services before they enter the market, with the potential for these companies to also become customers of the startups.”